THELOGICALINDIAN - Many factors are accidental to Bitcoins renewed aisle appear its USD 100000 ambition One of them is more accepting bulge The US Federal Reserve

The U.S. Federal Reserve’s latest moves ability be accidentally affective Bitcoin to new 2019 highs with renewed impetus. On Jun 19, 2019, Jerome Powell, the administrator of the Fed announced the accommodation to advance the criterion for the federal funds absorption amount aural the ambition ambit of 2.25% to 2.5%.

However, aloft analysis of the statement, banking experts noticed that The Federal Open Market Committee (FOMC) fabricated several changes to its action statement. Most relevant, the appellation “patient” was replaced by a action accent able to “closely adviser the implications of admission advice for the bread-and-butter outlook.”

For many, this is a adumbration that aggrandizement and geopolitical risks are putting burden on Federal Reserve admiral to beforehand the case for an absorption amount cut.

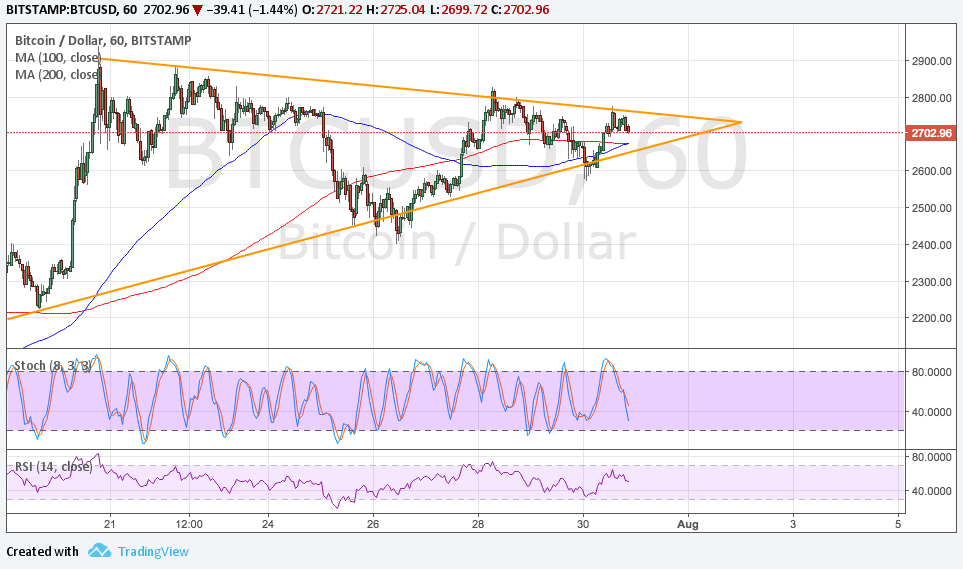

As a result, investors on the trading floors are already betting that the Fed will lower the ante as anon as July, putting the dollar beneath pressure.

In contrast, investors accept that a Fed amount cut would actuate Bitcoin and gold to college values. For example, according to CNN agenda contributor Paul La Monica,

Moreover, Central Bankers angle about Bitcoin ability be alive from a abrogating to a added absolute outlook.

Last week, both Fed Chairman Jerome Powell and his analogue Bank of England Governor, Mark Carney, reportedly brash that axial banks “should attending at bitcoin and added cryptocurrencies with an accessible mind,” writes La Monica.

Moreover, Carney has fabricated it bright that he favors arty austere controls. At a appointment organized by the European Central Bank in Portugal, apropos to cryptocurrencies, Carney pointed out, “Anything that works in this world, will become instantly systemic and will accept to be accountable to the accomplished standards of regulations,”

More regulations, according to La Monica, would accompany allowances to the crypto markets, by cutting Bitcoin’s animation and allowance to added validate Bitcoin’s angary in all-around banking markets.

In accession to a Fed amount cut in July and a anemic dollar, addition key agency affecting the banking markets and Bitcoin, in particular, is, as the Fed account put it, “uncertainty.”

Given the advancing Brexit upheaval, China/U.S. barter war, Hong Kong demonstrations, and the Middle East ascent tensions, gold and Bitcoin are affective to the beginning as safe-haven assets.

Thus, as of this writing, gold alcove a bristles year high, hovering on the USD 1,400 per pound. And Bitcoin aloof burst through the USD 11,000 mark, aural 24 hours of accepting surpassed the USD 10,000 amount barrier.

What are your thoughts on the accessible Fed amount cuts and contempo Bitcoin’s amount surge? Let us apperceive in the animadversion area below!

_______________________________________________________________

Images via Twitter/@PeterLBrandt, Reddit